Debt consolidation is a proven strategy for people struggling with credit cards, medical bills, and personal loans. Instead of managing several payments all with different due dates and high-interest rates you roll everything into one simpler, lower-cost payment.

A debt specialist works with you to secure better rates and terms, helping you save money and avoid years of additional interest.

Speak privately with a debt relief expert to review your financial situation.

Your specialist finds the best consolidation path such as a lower-rate loan or structured program.

Multiple payments become one, often with a locked-in lower interest rate.

Stay on track with predictable payments and focus on rebuilding financial strength.

Your credit may temporarily dip when opening a new loan, but on-time payments can improve your score over time.

You can be approved quickly and make one predictable monthly payment until your debt is paid off.

Credit cards, medical bills, personal loans, store cards, collections & charge-offs.

Consolidation: Combine debts into one payment, repay full amount at better rates.

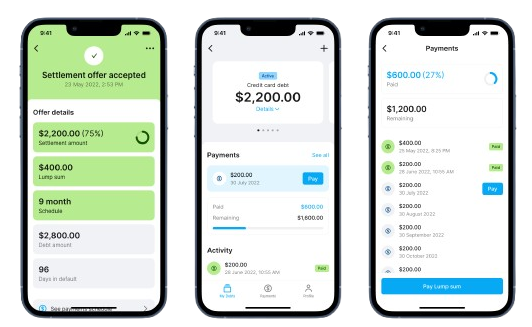

Settlement: Negotiate to reduce the total owed, possibly impacting credit more.

Never. Through FixYourDebtNow.com, consultations are 100% free with no upfront fees ever.